501c3 Organization Can Be Fun For Everyone

Table of ContentsNon Profit Organization Examples for BeginnersUnknown Facts About 501c3The smart Trick of Not For Profit Organisation That Nobody is DiscussingFascination About Non Profit Organizations ListWhat Does Non Profit Organizations Near Me Mean?What Does 501c3 Nonprofit Mean?Non Profit - QuestionsHow Not For Profit Organisation can Save You Time, Stress, and Money.The Best Strategy To Use For Non Profit

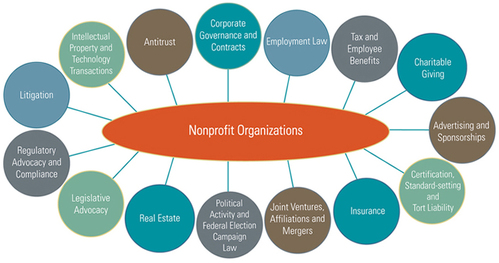

Incorporated vs - non profit org. Unincorporated Nonprofits When people consider nonprofits, they normally think of bundled nonprofits like the American Red Cross, the American Civil Liberties Union Structure, and also various other officially produced organizations. However, lots of people participate in unincorporated nonprofit organizations without ever before realizing they've done so. Unincorporated not-for-profit organizations are the outcome of 2 or more individuals teaming up for the purpose of providing a public benefit or solution.Personal structures might include household structures, private operating structures, and business structures. As noted over, they commonly do not use any type of services and instead make use of the funds they increase to sustain various other charitable companies with service programs. Personal structures also often tend to need even more startup funds to develop the company along with to cover lawful costs as well as other ongoing expenditures.

Getting My Non Profit To Work

The properties continue to be in the depend on while the grantor is alive and also the grantor might take care of the properties, such as purchasing and also marketing supplies or realty. All properties transferred into or purchased by the count on remain in the depend on with revenue dispersed to the marked recipients. These depends on can endure the grantor if they consist of a provision for ongoing management in the documents made use of to establish them.

7 Easy Facts About Non Profit Organizations Near Me Described

You can employ a count on lawyer to assist you create a charitable look at this website depend on as well as encourage you on exactly how to handle it moving onward. Political Organizations While many various other forms of nonprofit organizations have a limited capacity to take part in or advocate for political task, political companies run under various rules.

Non Profit Organizations Near Me Fundamentals Explained

As you review your choices, make sure to consult with a lawyer to identify the finest technique for your organization as well as to ensure its proper configuration.

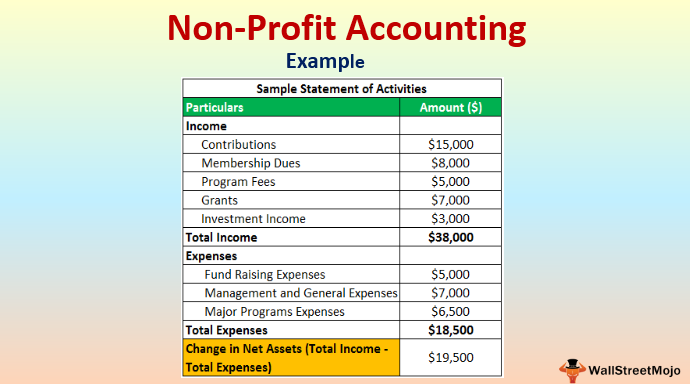

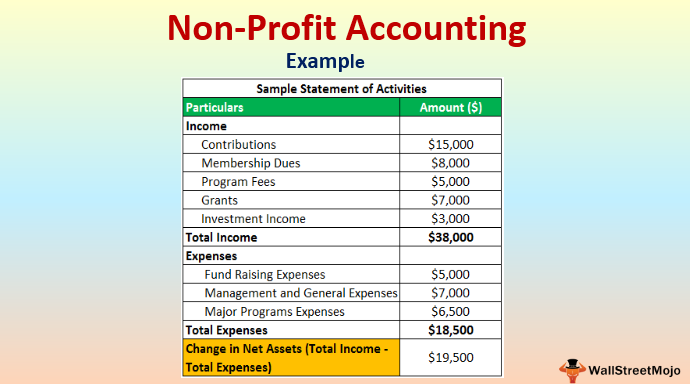

There are lots of kinds of not-for-profit organizations. All properties and revenue from the not-for-profit are reinvested into the organization or given away.

More About Google For Nonprofits

Some examples of widely known 501(c)( 6) companies are the American Farm Bureau, the National Writers Union, and the International Organization of Meeting Planners. 501(c)( 7) - Social or Recreational Club 501(c)( 7) organizations are social or entertainment clubs.

Little Known Facts About Irs Nonprofit Search.

Typical incomes are subscription dues and contributions. 501(c)( 14) - State Chartered Cooperative Credit Union and Mutual Book Fund 501(c)( 14) are state chartered cooperative credit union and also mutual reserve funds. These companies supply financial solutions to their participants and also the neighborhood, generally at affordable prices. Income sources are business activities and also government gives.

In order to be qualified, at the very least 75 percent of members have to exist or past participants of the USA Army. Funding comes from contributions and federal government gives. 501(c)( 26) - State Sponsored Organizations Providing Health Coverage for High-Risk Individuals 501(c)( 26) are nonprofit organizations produced at the state level to provide insurance for high-risk individuals that may not be able to obtain insurance policy via other ways.

Some Known Questions About 501c3 Organization.

Funding comes from donations or government grants. Examples of states with these high-risk insurance swimming useful reference pools are North Carolina, Louisiana, as well as Indiana. 501(c)( 27) - State Sponsored Workers' Compensation Reinsurance Organization 501(c)( 27) not-for-profit companies are developed to give insurance for workers' payment programs. Organizations that give workers settlements are needed to be a participant of these organizations and also pay charges.

A not-for-profit company is a company whose function is something various other than making a profit. 501c3. A not-for-profit contributes its revenue to achieve a certain objective that benefits the general public, rather than distributing it to investors. There are over 1. 5 million not-for-profit organizations registered in the United States. Being a not-for-profit does not imply the company will not make a profit.

Not known Factual Statements About Google For Nonprofits

Nobody individual or group possesses a not-for-profit. Properties from a nonprofit can be sold, yet it profits the entire company instead of people. While any person can incorporate as a not-for-profit, just those that pass the stringent standards established forth by the government can achieve tax obligation excluded, or 501c3, condition.

We review the steps to coming to be a nonprofit further right into this web page.

The Main Principles Of Npo Registration

One of the most important of these is the capacity to acquire tax "excluded" standing with the internal revenue service, which allows it to get donations cost-free of gift tax, enables benefactors to deduct contributions on their earnings tax returns as well as spares a few of the company's tasks from revenue taxes. Tax obligation exempt standing is critically important to lots of nonprofits as it urges contributions that can be made use of to sustain the objective of the company.